According to the International Data Corporation (IDC) Worldwide Artificial Intelligence Spending Guide, spending on AI systems will accelerate over the next several years as organizations deploy artificial intelligence as part of their digital transformation efforts and to remain competitive in the digital economy. The compound annual growth rate (CAGR) for the 2019-2024 period will be 20.1%.

"Companies will adopt AI — not just because they can, but because they must," said Ritu Jyoti, program vice president, Artificial Intelligence at IDC. "AI is the technology that will help businesses to be agile, innovate, and scale. The companies that become 'AI powered' will have the ability to synthesize information (using AI to convert data into information and then into knowledge), the capacity to learn (using AI to understand relationships between knowledge and apply the learning to business problems), and the capability to deliver insights at scale (using AI to support decisions and automation)."

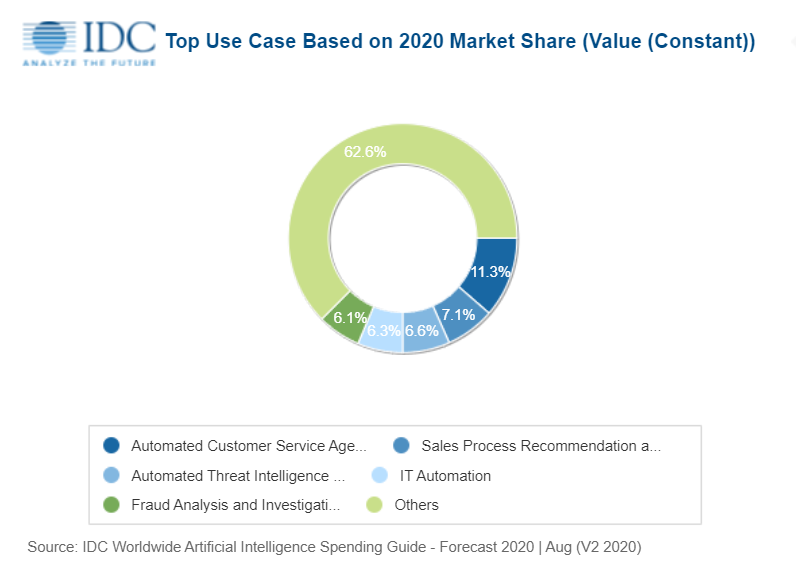

Two of the leading drivers for AI adoption are delivering a better customer experience and helping employees to get better at their jobs. This is reflected in the leading use cases for AI, which include automated customer service agents, sales process recommendation and automation, automated threat intelligence and prevention, and IT automation. Combined, these four use cases will represent nearly a third of all AI spending this year. Some of the fastest growing use cases are automated human resources, IT automation, and pharmaceutical research and discovery.

The two industries that will spend the most on AI solutions throughout the forecast are Retail and Banking. The Retail industry will largely focus its AI investments on improving the customer experience via chatbots and recommendation engines while Banking will include spending on fraud analysis and investigation and program advisors and recommendation systems. Discrete Manufacturing, Process Manufacturing, and Healthcare will round out the top 5 industries for AI spending in 2020. The industries that will see the fastest growth in AI spending over the 2020-2024 forecast are Media, Federal/Central Government, and Professional Services.

"COVID-19 caused a slowdown in AI investments across the Transportation industry as well as the Personal and Consumer Services industry, which includes leisure and hospitality businesses. These industries will be cautious with their AI investments in 2020 as their focus will be on cost containment and revenue generation rather than innovation or digital experiences," said Andrea Minonne, senior research analyst, Customer Insights & Analysis. "On the other hand, AI has played a role in helping societies deal with large-scale disruptions caused by quarantines and lockdowns. Some European governments have partnered with AI start-ups to deploy AI solutions to monitor the outcomes of their social distancing rules and assess if the public was complying with rules. Also, hospitals across Europe are using AI to speed up COVID-19 diagnosis and testing, to provide automated remote consultations, and to optimize capacity at hospitals."

"This release of the Artificial Intelligence Spending Guide was adjusted for the impact of COVID-19," said Stacey Soohoo, research manager, Customer Insights & Analysis. "In the short term, the pandemic caused supply chain disruptions and store closures with continued impact expected to linger into 2021 and the outyears. For the most impacted industries, this has caused some delays in AI deployments. Elsewhere, enterprises have seen a silver lining in the current situation: an opportunity to become more resilient and agile in the long run. Artificial intelligence continues to be a key technology in the road to recovery for many enterprises and adopting artificial intelligence will help many to rebuild or enhance future revenue streams and operations."

Software and services will each account for a little more than one third of all AI spending this year with hardware delivering the remainder. The largest share of software spending will go to AI applications ($14.1 billion) while the largest category of services spending will be IT services ($14.5 billion). Servers ($11.2 billion) will dominate hardware spending. Software will see the fastest growth in spending over the forecast period with a five-year CAGR of 22.5%.

On a geographic basis, the United States will deliver more than half of all AI spending throughout the forecast, led by the Retail and Banking industries. Western Europe will be the second largest geographic region, led by Banking, Retail, and Discrete Manufacturing. China will be the third largest region for AI spending with State/Local Government, Banking, and Professional Services as the leading industries. The strongest spending growth over the five-year forecast will be in Japan (32.1% CAGR) and Latin America (25.1% CAGR).